Are you worried about your family’s financial future? Do you want to ensure that your loved ones are taken care of after you’re gone? If so, then you need to consider working with a trust attorney. A trust attorney can help you create a trust that will protect your assets and ensure that your wishes are carried out.

A trust is a legal document that allows you to transfer your assets to a trustee, who will then manage the assets for the benefit of your beneficiaries. This can be especially important if you have minor children or if you are concerned about your assets being misused.

What is a Trust Attorney?

A trust attorney is a lawyer who specializes in estate planning and the creation and administration of trusts. They are also known as estate planning attorneys. They are legal professionals who possess extensive knowledge of trust law and related areas such as probate, asset protection, and tax planning.

These attorneys work closely with clients to create personalized trusts that reflect their specific goals and financial situations. They understand how to draft legal documents that protect assets and ensure their distribution according to the client’s wishes.

Trust attorneys are essential for individuals who want to ensure their assets are managed and distributed according to their wishes after their death. They can help create a plan that protects your loved ones and minimizes potential tax burdens.

How to Set Up a Trust with Legal Help

Setting up a trust can be a complex process, and it’s crucial to seek legal guidance from a trust attorney. They are experts in estate planning and can help you create a trust that aligns with your specific goals and circumstances. Here’s how a trust attorney can assist you with setting up a trust:

1. Determine the type of trust: There are various types of trusts, each serving different purposes. A trust attorney will guide you in selecting the best type of trust based on your assets, beneficiaries, and objectives. For example, you may need a revocable living trust for estate planning, or an irrevocable trust for asset protection.

2. Draft the trust document: The trust document outlines the terms of the trust, including the trustee’s duties, the beneficiaries, and the distribution of assets. A trust attorney ensures the document is legally sound and tailored to your specific requirements. They will incorporate your wishes regarding asset distribution, tax implications, and other important factors.

3. Fund the trust: After the trust is established, you need to transfer your assets into the trust. A trust attorney can help you with the process, ensuring proper documentation and tax compliance. They will advise you on the best approach to fund the trust based on your specific situation.

4. Choose a trustee: The trustee manages the trust assets according to the trust document. A trust attorney can assist you in selecting a suitable trustee, either a family member, a professional, or a trust company. They can help you navigate the complexities of trustee responsibilities and ensure the trustee’s competence and integrity.

5. Review and update the trust: Your circumstances can change over time, requiring adjustments to your trust. A trust attorney can review and update the trust document to ensure it remains consistent with your current goals and legal requirements.

By working with a trust attorney, you can be confident that your trust is properly structured and legally compliant. This ensures the protection of your assets and the fulfillment of your wishes for your loved ones.

The Role of Lawyers in Trust Administration

A trust attorney plays a vital role in trust administration, providing guidance and expertise to ensure the smooth operation and fulfillment of the trust’s objectives. Their role is crucial in protecting the interests of beneficiaries and upholding the grantor’s wishes. Trust administration encompasses managing the trust’s assets, distributing income and principal to beneficiaries, complying with tax regulations, and handling legal and administrative matters.

Here are some key responsibilities of a trust attorney in trust administration:

- Drafting and reviewing trust documents: Trust attorneys ensure that the trust document accurately reflects the grantor’s wishes and complies with legal requirements. They draft or review the trust instrument, including provisions regarding asset allocation, beneficiary distribution, and succession planning.

- Guiding the trustee: Trust attorneys provide legal advice and guidance to the trustee, helping them understand their responsibilities and navigate complex legal and financial issues. They offer counsel on asset management, investment strategies, distribution procedures, and compliance with relevant laws.

- Resolving disputes: Conflicts may arise among beneficiaries or between beneficiaries and the trustee. Trust attorneys act as mediators or legal representatives to resolve disputes amicably or through legal proceedings, ensuring that the trust’s purpose and the grantor’s intentions are upheld.

- Ensuring compliance: Trust attorneys ensure that the administration of the trust adheres to all applicable laws, regulations, and tax requirements. They advise on tax planning strategies, estate tax reporting, and compliance with reporting obligations.

- Protecting the interests of beneficiaries: Trust attorneys safeguard the interests of beneficiaries, ensuring that they receive their rightful share of the trust’s assets according to the terms of the trust document. They advocate for beneficiaries’ rights and act as their legal representatives if necessary.

How a Trust Attorney Can Protect Your Family’s Assets

A trust attorney is a lawyer who specializes in creating and administering trusts. Trusts are legal arrangements that allow you to transfer your assets to a trustee, who will manage them for the benefit of your beneficiaries. A trust attorney can help you to protect your assets from creditors, taxes, and lawsuits.

One of the most important things a trust attorney can do is help you to create a trust that is tailored to your specific needs and goals. This includes deciding who will be the trustee and beneficiaries of the trust, as well as how the assets will be distributed.

A trust attorney can also help you to avoid probate, which is the court process that is used to distribute the assets of a deceased person. Probate can be a lengthy and expensive process, and it can also expose your assets to creditors and lawsuits.

If you are concerned about protecting your family’s assets, you should consult with a trust attorney. A trust attorney can help you to create a plan that will protect your assets and ensure that they are distributed according to your wishes.

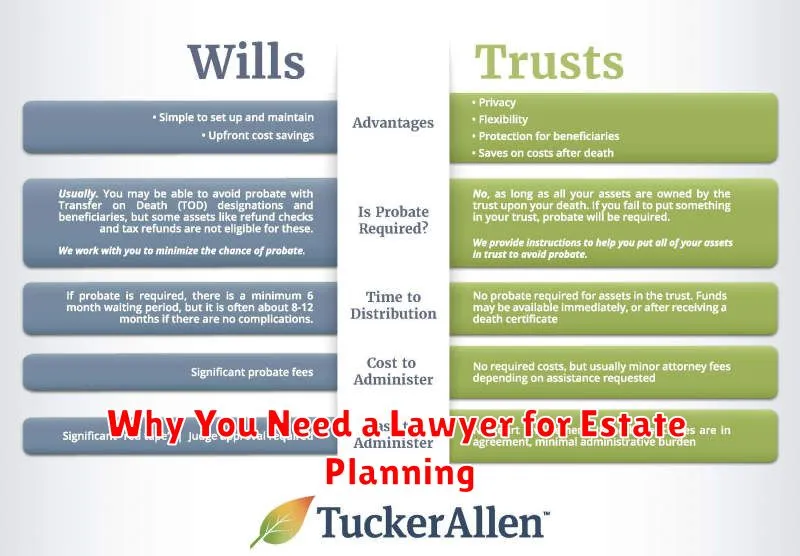

Why You Need a Lawyer for Estate Planning

Estate planning is an essential part of ensuring your family’s financial security and peace of mind. It involves planning for the distribution of your assets after your death, including property, investments, and other valuable possessions. While it might seem daunting, a trust attorney can provide invaluable assistance in navigating this process effectively. Here’s why seeking legal advice is crucial for your estate planning:

Expertise and Knowledge: Estate laws are complex and can vary significantly depending on your location. A trust attorney possesses specialized knowledge of these laws and can guide you in making informed decisions regarding your estate. They will ensure your plan complies with legal requirements and protects your beneficiaries’ interests.

Personalized Planning: Every individual’s situation is unique. A trust attorney will take the time to understand your specific needs, goals, and family dynamics to create a customized estate plan tailored to your circumstances. They will consider factors such as your age, health, family structure, and financial goals to ensure your plan aligns with your wishes.

Protecting Your Assets: Properly structured estate planning can help safeguard your assets from potential challenges like estate taxes, probate proceedings, and legal disputes. An attorney can advise you on minimizing taxes, avoiding probate, and protecting your family’s inheritance from creditors or challenges from estranged family members.

Peace of Mind: Planning for your eventual passing can be emotionally challenging. However, having a well-structured estate plan provides peace of mind knowing that your wishes will be carried out and your loved ones will be financially protected. A trust attorney can alleviate the burden of this task and offer valuable support during this process.

In conclusion, seeking legal advice from a trust attorney is essential for comprehensive and effective estate planning. Their expertise, personalized approach, and legal guidance can ensure your assets are distributed according to your wishes, minimizing legal complexities and providing your loved ones with financial security and peace of mind.

How to Choose the Right Trust Attorney

Choosing the right trust attorney is crucial for securing your family’s financial future. This attorney will guide you through the complex process of setting up a trust, ensuring your assets are managed and distributed according to your wishes, and protecting your loved ones from unnecessary financial burdens.

Here are some key factors to consider when selecting a trust attorney:

- Experience and Specialization: Look for an attorney who has extensive experience in estate planning and trusts, ideally with a proven track record in handling cases similar to yours.

- Communication Skills: Choose an attorney who is a good communicator, patiently explains complex legal concepts, and listens attentively to your needs and concerns.

- Reputation and Integrity: Research the attorney’s reputation and professional standing within the legal community. Look for positive reviews and testimonials from past clients.

- Fees and Payment Structure: Discuss the attorney’s fees and payment structure upfront to ensure transparency and avoid any surprises later on.

- Availability and Responsiveness: Select an attorney who is readily available to answer your questions, address your concerns, and provide timely updates throughout the process.

It’s essential to interview several trust attorneys before making a decision. During the interview, ask them about their experience, approach to estate planning, and their understanding of your specific needs and goals. Don’t hesitate to ask any questions that arise and ensure you feel comfortable and confident in their expertise and professionalism.

What to Expect During a Trust Consultation

A trust consultation is a valuable opportunity to discuss your family’s financial future with a qualified attorney. During this meeting, you’ll have the chance to learn about the different types of trusts and how they can benefit your loved ones. The attorney will ask questions to understand your unique circumstances and goals. This may include:

* Your assets: What type of assets do you own, and how are they currently titled? * Your beneficiaries: Who do you want to inherit your assets? * Your goals: What are your reasons for establishing a trust? Do you want to protect your assets from taxes or creditors? Do you want to provide for your loved ones after you pass away? * Your concerns: What are your concerns about the future of your estate?

The attorney will then provide information about different trust options that could fit your needs. They will also discuss the potential costs associated with setting up and maintaining a trust.

Here are some things to keep in mind:

- Bring a list of your assets and beneficiaries.

- Come prepared to ask questions.

- Be honest and open about your situation.

A trust consultation can be a positive first step in securing your family’s financial future. It’s an opportunity to get personalized advice and guidance from a professional who can help you make informed decisions about your estate planning.

How to Minimize Estate Taxes with a Lawyer’s Help

Estate taxes can be a significant burden on your family after you pass away. A trust attorney can help you minimize estate taxes by implementing strategies like creating a trust or gifting assets. They can help you understand the complex rules and regulations surrounding estate taxes and ensure that your assets are distributed in a way that minimizes the tax burden on your beneficiaries.

A trust attorney can create a personalized estate plan that addresses your specific needs and goals. They can help you decide which type of trust is right for you, such as a revocable living trust or an irrevocable trust. They can also advise you on how to gift assets to your beneficiaries in a way that minimizes taxes and avoids gift tax penalties.

By working with a trust attorney, you can ensure that your family’s financial future is protected and that your assets are distributed according to your wishes.

The Importance of Legal Guidance in Wealth Management

Wealth management is more than just investing your money wisely. It’s about safeguarding your assets and ensuring your family’s financial future. This is where the expertise of a trust attorney becomes crucial. They offer a comprehensive approach to wealth management that goes beyond just financial planning.

A trust attorney provides essential legal guidance, helping you navigate the complex legal landscape associated with wealth management. They can help you establish trusts, wills, and other legal structures that protect your assets and minimize estate taxes. They also ensure your wishes are carried out according to your plan, preventing potential disputes and ensuring your family’s financial security.

Beyond estate planning, trust attorneys provide valuable insights into asset protection. They can help you structure your assets in a way that shields them from potential liabilities, including lawsuits, creditors, and even divorce. This can significantly protect your wealth and ensure your family’s financial stability.

Trust attorneys also offer essential guidance in navigating complex tax implications associated with wealth management. They help you develop strategies to minimize tax liabilities and optimize your wealth transfer to future generations. This ensures your hard-earned assets are maximized and utilized effectively to benefit your family.

In essence, a trust attorney acts as your trusted advisor, guiding you through the complexities of wealth management with legal expertise and strategic insight. Their comprehensive approach ensures your wealth is preserved, protected, and transferred according to your wishes, safeguarding your family’s financial future.

Questions to Ask a Trust Attorney Before Hiring

Hiring a trust attorney is a crucial step in ensuring your family’s financial future. A trust attorney can help you create a trust that protects your assets, minimizes taxes, and ensures your wishes are followed after you’re gone. Before you hire a trust attorney, it’s important to ask the right questions to ensure you’re working with the right person for your needs. Here are some questions to ask a trust attorney before hiring:

What is your experience with trusts? This question helps you determine whether the attorney has the necessary expertise to handle your specific needs. You should look for an attorney with experience in creating and administering trusts, as well as experience in estate planning and probate.

What types of trusts do you specialize in? Not all trusts are created equal. There are different types of trusts, each with its own benefits and drawbacks. It’s important to choose an attorney who specializes in the type of trust that’s right for you. For example, if you’re looking to create a trust for a minor child, you’ll need an attorney who specializes in trusts for minors.

How much do your services cost? Trust attorney fees can vary widely. It’s important to get a clear understanding of the attorney’s fees before you hire them. Ask about their hourly rates, any flat fees, and any other potential costs. Remember that trust attorneys may charge separate fees for different tasks, like creating the trust, filing paperwork, and managing the trust after it’s been established.

What is your process for creating a trust? Understanding the attorney’s process for creating a trust can help you determine if they’re the right fit for you. Ask about the steps involved, the amount of time it will take, and any specific documents you’ll need to provide. It’s important to feel comfortable with the process and confident in the attorney’s ability to help you create a trust that meets your needs.

Do you have any experience working with clients in my situation? Sharing your unique situation with the attorney can help you determine their level of experience working with similar cases. This can help you ensure that the attorney is familiar with the specific challenges you may face and can provide you with the guidance and support you need.

By asking these questions, you can ensure you’re choosing a qualified trust attorney who can help you secure your family’s financial future.

How Lawyers Help with Charitable Trusts

A charitable trust is a legal arrangement where you transfer assets to a trustee to manage and distribute the funds for a charitable purpose. Attorneys play a crucial role in setting up and managing these trusts, ensuring that your philanthropic goals are met while adhering to legal requirements.

Here are some key ways lawyers assist with charitable trusts:

- Drafting the Trust Document: Attorneys create the legal document that outlines the specific terms of the trust, including the charitable purpose, beneficiaries, and distribution guidelines.

- Compliance with Legal Requirements: Lawyers ensure that the trust complies with all applicable state and federal laws governing charitable organizations and tax-exempt status.

- Choosing the Right Trustee: Attorneys can guide you in selecting a suitable trustee, who will manage the trust assets and distribute funds responsibly according to your instructions.

- Tax Planning: Lawyers help minimize tax implications for both the donor and the trust, ensuring maximum charitable impact while reducing tax burdens.

- Protecting the Trust Assets: Attorneys advise on strategies to protect the trust’s assets from potential liabilities and ensure long-term financial stability.

- Monitoring and Reporting: Lawyers assist with ongoing monitoring of the trust’s operations, ensuring that funds are used appropriately and that the charitable purpose is fulfilled.

Charitable trusts offer a unique opportunity to make a lasting difference while potentially achieving tax benefits. Working with an experienced trust attorney ensures that your charitable intentions are carried out effectively and legally.

The Legal Process in Setting Up a Living Trust

Establishing a living trust is a significant step in securing your family’s financial future. It involves a legal process that requires careful planning and execution. Here’s a general overview of the process:

1. Consultation with a Trust Attorney: The first step is to consult with a qualified trust attorney. They will guide you through the process, explain the different types of trusts, and help you determine the best option for your circumstances. The attorney will also help you identify and address any potential tax implications.

2. Drafting the Trust Document: Your attorney will draft the trust document, outlining the terms of your trust. This document will specify the assets included in the trust, the beneficiaries who will inherit the assets, and the responsibilities of the trustee who will manage the trust. It’s crucial to involve your attorney in this process to ensure that the document accurately reflects your wishes and complies with legal requirements.

3. Funding the Trust: After the trust document is finalized, you must transfer your assets into the trust. This process may involve retitling properties, changing bank account ownership, and updating other financial accounts. The attorney can provide guidance on the specific steps involved.

4. Signing and Execution: You will sign the trust document, and it may require notarization, depending on your state’s laws. This formally establishes the trust and ensures its legal validity.

5. Ongoing Management: Once the trust is set up, you (as the grantor) or the trustee will manage the assets according to the terms of the trust document. You may need to update the trust document over time, such as in case of major life changes or changes in tax laws. Your attorney can help you navigate these updates and ensure the trust continues to meet your goals.

How to Protect Your Children’s Inheritance with a Lawyer

Protecting your children’s inheritance can be a complex and daunting task. A trust attorney can guide you through this process and ensure that your loved ones receive their inheritance in a way that aligns with your wishes and protects them from potential pitfalls.

Here are some key ways a trust attorney can help protect your children’s inheritance:

1. Creating a Trust: A trust is a legal arrangement where you transfer assets to a trustee, who manages them for the benefit of your beneficiaries. A trust attorney can help you create a trust that meets your specific needs and protects your children’s inheritance from creditors, lawsuits, and poor financial management.

2. Managing Assets: If your children are minors or not financially savvy, a trust can provide a framework for managing their inheritance until they are ready to receive it. This ensures that the money is used responsibly and does not get squandered or lost due to poor financial choices.

3. Protecting Against Taxes: A trust attorney can advise you on ways to minimize the tax implications of your inheritance. This can involve structuring the trust in a way that reduces estate taxes or capital gains taxes.

4. Avoiding Probate: Probate is the legal process of distributing assets after someone dies. This can be time-consuming, costly, and public. A trust can help you avoid probate, ensuring a smoother and more private transfer of assets to your children.

5. Special Needs Planning: If your child has special needs, a trust attorney can create a trust that protects their government benefits, such as Social Security or Medicaid. This ensures that their inheritance does not jeopardize their eligibility for these crucial programs.

By working with a trust attorney, you can feel confident that your children’s inheritance is protected, managed effectively, and distributed according to your wishes.

Why Legal Representation is Important in Trust Litigation

Trust litigation can be a complex and challenging process, with high stakes for all parties involved. Navigating the legal system without proper legal representation can be a daunting task, leaving you vulnerable to potential errors and pitfalls. A trust attorney is an essential ally in protecting your rights and interests in such a situation. They can provide invaluable guidance and expertise throughout the litigation process, ensuring that your position is presented effectively and your legal rights are upheld.

A skilled trust attorney can:

- Understand complex legal issues related to trust litigation, including interpretation of the trust document, beneficiary rights, and fiduciary duties.

- Strategically navigate the litigation process, ensuring that all necessary steps are taken in a timely and efficient manner.

- Negotiate with opposing counsel to reach a favorable settlement or to prepare for trial if necessary.

- Represent you in court, advocating for your interests and presenting a strong legal case on your behalf.

- Protect your interests, preventing potential breaches of the trust or violations of your rights as a beneficiary.

By having legal representation in trust litigation, you gain access to a valuable resource that can significantly improve your chances of achieving a successful outcome. This includes safeguarding your financial future and ensuring the fair and proper distribution of trust assets.

How to Build a Strong Estate Plan with Legal Help

A strong estate plan is essential for securing your family’s financial future. It ensures your assets are distributed according to your wishes, minimizes taxes and probate fees, and protects your loved ones from financial hardship. While creating an estate plan can seem daunting, working with a trust attorney can significantly simplify the process and ensure your plan is comprehensive and legally sound.

Here are some key steps involved in building a strong estate plan with legal help:

- Inventory your assets and liabilities: Begin by compiling a list of all your assets, including real estate, bank accounts, investments, and personal property. Also, document any debts or liabilities you may have.

- Identify your beneficiaries: Determine who you want to inherit your assets and in what proportions. Consider creating a list of potential beneficiaries, including family members, friends, charities, or trusts.

- Choose the right estate planning tools: A trust attorney can guide you in selecting the appropriate estate planning tools to meet your specific needs. These can include a will, revocable living trust, irrevocable trust, power of attorney, and advance healthcare directive.

- Minimize taxes and probate fees: An experienced attorney can help you implement strategies to minimize estate taxes and probate fees, ensuring your beneficiaries receive the maximum inheritance possible.

- Review and update your estate plan regularly: Your life circumstances can change, requiring adjustments to your estate plan. Regularly review and update your plan to reflect any changes, such as births, deaths, marriages, divorces, or major asset acquisitions or disposals.

By working with a trust attorney, you can build a comprehensive and effective estate plan that protects your family’s financial security and ensures your wishes are carried out after you are gone.

The Role of Lawyers in Irrevocable Trusts

Irrevocable trusts, as the name suggests, are trusts that cannot be revoked or amended once they are established. They are often used for estate planning, asset protection, and tax purposes. While they provide significant benefits, they are also complex and require the guidance of a skilled estate planning attorney.

Here’s where a lawyer plays a crucial role:

- Drafting the Trust Document: Lawyers are essential in drafting the trust document. This document outlines the terms and conditions of the trust, including the assets to be transferred, the beneficiaries, and the trustee’s responsibilities.

- Choosing the Right Trustee: The trustee is responsible for managing the trust’s assets and distributing them to the beneficiaries. A lawyer can help you choose the most suitable trustee, whether it be a family member, financial institution, or trust company.

- Minimizing Tax Implications: Irrevocable trusts can help minimize estate taxes and gift taxes. A lawyer can strategize to ensure the trust structure minimizes tax burdens for the beneficiaries and the estate.

- Protecting Assets: Irrevocable trusts can also help protect assets from creditors and lawsuits. A lawyer can ensure that the trust is drafted in a way that safeguards assets against potential threats.

Ultimately, an estate planning lawyer is your advocate in establishing an irrevocable trust. They provide legal expertise to ensure the trust is properly structured and meets your specific goals, protecting your family’s financial future and maximizing the benefits of this powerful estate planning tool.

How a Trust Attorney Can Help Avoid Probate

Probate is the legal process of distributing a deceased person’s assets. It can be a lengthy and expensive process, and it can be avoided altogether with proper estate planning. A trust attorney can help you set up a trust, which is a legal document that allows you to transfer your assets to your beneficiaries without going through probate.

A trust is a legal arrangement where you, as the grantor, transfer ownership of your assets to a trustee, who manages the assets for the benefit of your beneficiaries. When you die, the assets in the trust will be distributed according to your instructions, without having to go through the probate court. This can save your family time, money, and stress.

Here are some of the ways a trust attorney can help you avoid probate:

- Drafting a trust agreement that meets your specific needs.

- Choosing the right trustee to manage your assets.

- Ensuring that your trust is properly funded and administered.

- Advising you on the tax implications of your trust.

If you are concerned about the probate process and want to ensure that your assets are distributed according to your wishes, a trust attorney can help you create a comprehensive estate plan that includes a trust. By working with a trust attorney, you can protect your family’s financial future and avoid the hassle and expense of probate.

Why You Need Legal Assistance for Trust Disputes

Trusts are meant to simplify the distribution of assets after someone passes away. However, trust disputes can arise, causing confusion, frustration, and even legal battles. These disagreements can be complex and emotionally charged, making it essential to seek legal assistance.

A trust attorney possesses the expertise to navigate the intricate legal landscape of trust disputes. They can provide valuable guidance and representation in these sensitive matters. Here’s why seeking their assistance is crucial:

Understanding the Trust’s Terms: Trust attorneys have a deep understanding of trust law and can interpret the terms of the trust document accurately. This ensures that all parties involved understand the grantor’s intentions and how assets should be distributed.

Resolving Disputes: Disputes can arise from various issues, including beneficiaries challenging the trust’s validity, disagreements over asset distribution, or accusations of mismanagement. A trust attorney can help negotiate a settlement or represent you in court if necessary.

Protecting Your Interests: Trust disputes can be emotionally charged and often involve family members. Having a trust attorney on your side ensures that your interests are protected and that you receive your rightful share of the inheritance.

Avoiding Costly Litigation: While litigation is sometimes unavoidable, a trust attorney can often resolve disputes amicably through negotiation or mediation. This helps minimize legal fees and emotional strain.

If you are facing a trust dispute, seeking legal counsel from a qualified trust attorney is crucial. Their expertise and guidance can protect your rights, safeguard your interests, and bring resolution to a challenging situation.

How to Prepare for a Meeting with a Trust Attorney

Meeting with a trust attorney is a significant step in planning for your family’s financial future. To make the most of your consultation, be prepared with the following information.

1. Gather your financial documents: This includes bank statements, investment accounts, property deeds, insurance policies, and any other relevant documentation. Having this information readily available will help the attorney understand your financial situation and recommend appropriate solutions.

2. Define your goals: Think about what you want to achieve with a trust. Are you looking to protect your assets from creditors or taxes? Do you want to provide for your family’s financial needs after you pass away? Clarify your goals before the meeting so that the attorney can tailor their advice to your specific needs.

3. Prepare a list of questions: Make a list of questions you have about trusts and estate planning. This could include questions about the different types of trusts, the costs involved, and the process of setting up a trust. Having a prepared list will ensure that you cover all your concerns during the meeting.

4. Be open and honest: Be transparent with the attorney about your financial situation and your wishes for your family. This will enable them to develop a comprehensive and effective estate plan.

By being well-prepared for your meeting with a trust attorney, you can ensure that you get the most out of your consultation and take a proactive step toward securing your family’s financial future.